Friday, September 19, 2025

PDX: Price Disconnect Presents

PDX currently trades at an attractive discount to NAV valuation, as the price has not caught up to the strength of the earnings. Click to read why PDX is a Buy.

Monday, July 14, 2025

PDX: Buy Before The Discount C

Tuesday, July 1, 2025

2025 H1 Portfolio Review: More

My portfolio outperformed the S&P 500 as I deployed a larger than normal amount of cash into new trades. I remain cautiously bullish for H2 2025, expecting stronger returns ahead.

Saturday, June 28, 2025

5 Best CEFs This Month For Yie

Tuesday, June 17, 2025

ETO: Solid Yield And Well Posi

ETO offers a high 7.82% yield from a globally diversified, equity-heavy portfolio, with tax-advantaged distributions. Click for my ETO update.

Monday, June 9, 2025

PDX: Why PIMCO's Best Performi

PDX continues to outperform with strong multi-year returns, Venture Global upside, and a discount to NAV that remains attractive. Learn why PDX CEF is a buy.

Saturday, May 24, 2025

5 Best CEFs This Month For Yie

Thursday, May 15, 2025

Why I'm Fading The PIMCO Dynam

Sunday, May 4, 2025

PDX: Discount Widening Leads T

PIMCO Dynamic Income Strategy Fund (PDX) shifts to a multi-sector bond focus. Explore its recent performance, challenges, and growth potential.

Saturday, April 26, 2025

5 Best CEFs This Month For Yie

Read here for an analysis of 5 top CEFs with high distributions, solid track records, and unique discounts, perfect for income investors.

Sunday, April 20, 2025

PDX: High Income And Opportuni

Thursday, April 3, 2025

PDX: Consistent Performance Ha

PDX offers a 6.4% starting dividend yield and has achieved over 102% total return since its 2019 inception. See why I rate the fund a buy.

Friday, March 28, 2025

PIMCO CEF Update: Tight Spread

PIMCO's taxable CEFs gain on distribution coverage via interest rate swaps. Discover defensive strategies, reduced risk, and evolving valuations. Click for more.

Sunday, March 23, 2025

5 Best CEFs This Month For Yie

For income investors, closed-end funds remain an attractive investment class. Check out this month's five CEFs with solid track records.

Saturday, March 22, 2025

PIMCO March 2025 Update | PDI

Consider selling PDI and explore undervalued PIMCO funds like PAXS, PFN, and PHK for better value.

Monday, February 24, 2025

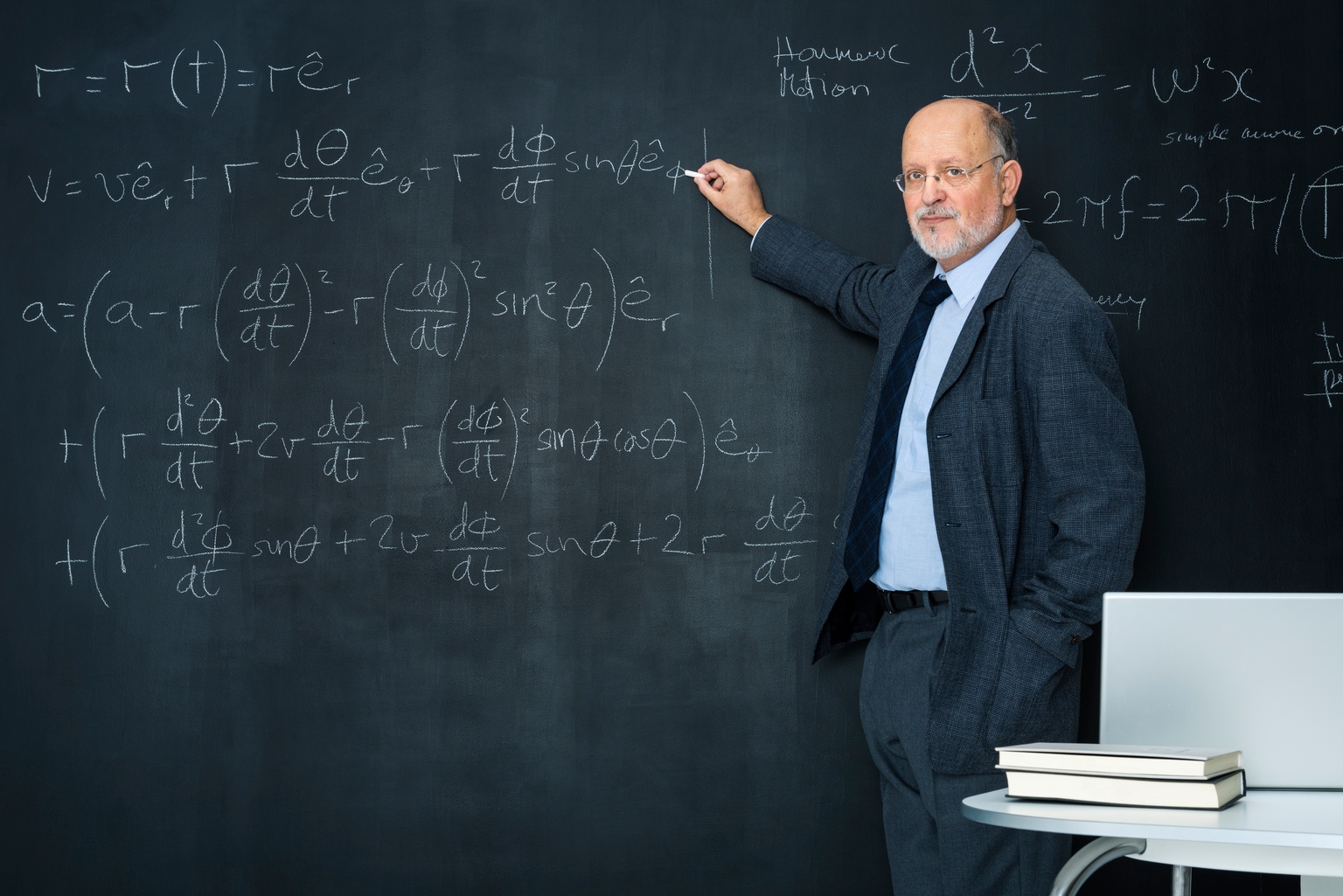

Very Bad News For Closed-End F

Closed-end funds offer unique opportunities due to their discount/premium mechanisms. Find out the bad news we have for CEF investors.

Sunday, February 23, 2025

5 Best CEFs This Month: Averag

For income investors, closed-end funds remain an attractive investment class. Check out five CEFs with solid track records that pay high distributions.

Saturday, February 1, 2025

CEF Weekly Review: BlackRock A

CEF market gains led by MLPs in January. Discover why we rotated from DHY to XFLT and how the PIMCO Dynamic Income Fund remains a solid valuation choice.

Thursday, January 30, 2025

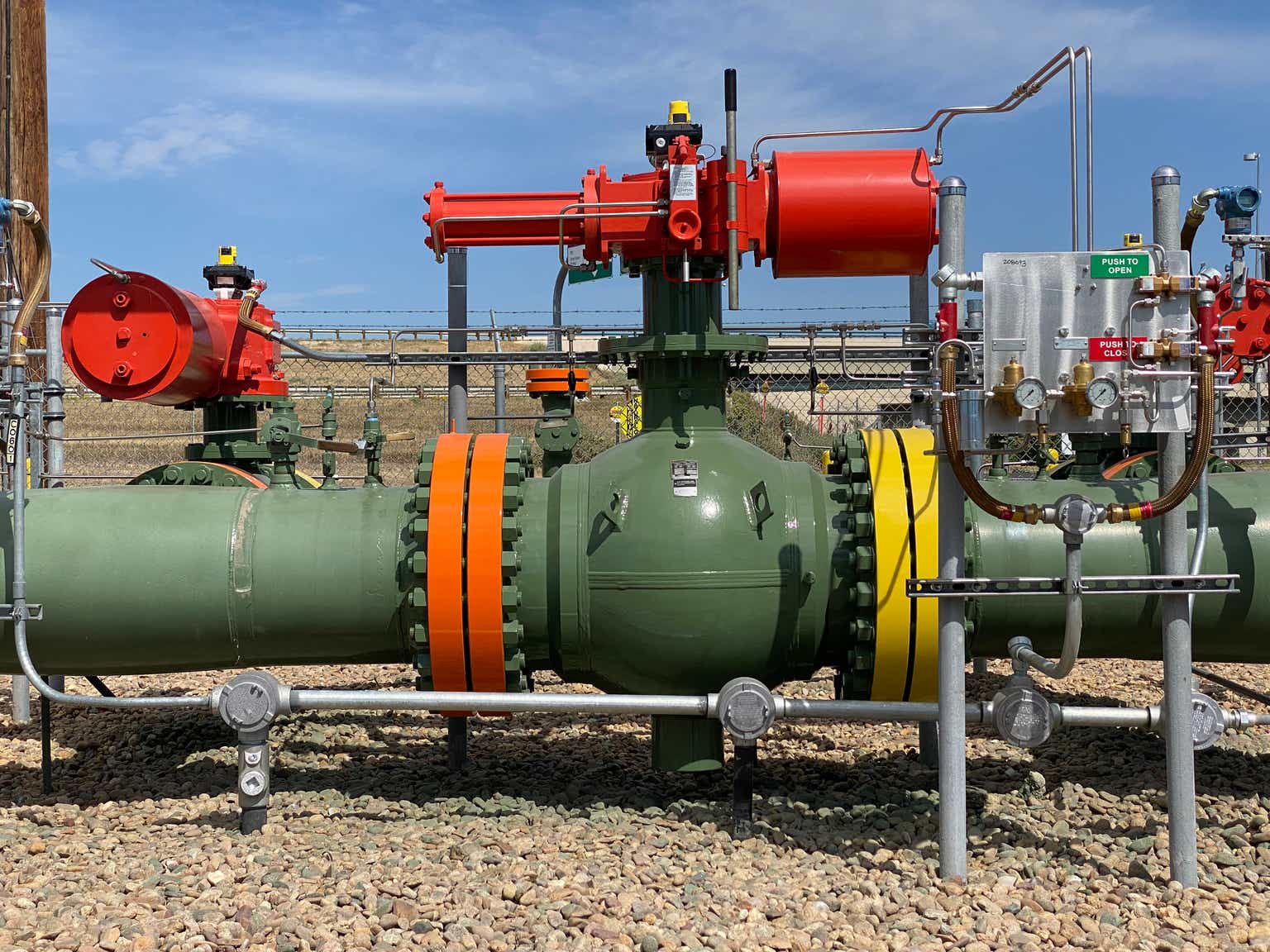

How Pimco, a Realm for Bond Ki

Bond manager’s $7 billion stake in Venture Global is latest sign that traditional asset managers are making inroads investing in all manner of private assets.

Wednesday, January 29, 2025

PDX: Still In The Driver's Sea

Don't panic over PDX's recent dip. Read why investors may see the share price tumble as a buying opportunity.

Thursday, January 23, 2025

PIMCO CEF Update: The Hammer C

Financial writer highlights distribution cuts by PIMCO, factors affecting sustainability, PDI's status, and positive impact of Venture Global's IPO on PDX.

Thursday, January 16, 2025

4 Closed-End Fund Buys (And A

Wednesday, January 15, 2025

PDX: The Big Move And Addition

PDX holds a significant stake in Venture Global, which is planning an IPO to raise $2-2.3bn with a $110bn valuation. Explore more details here.

Tuesday, January 14, 2025

Getting Our Bearings In The 20

Navigate the 2025 income market with key themes and market moves.

Monday, January 13, 2025

PDX: An Energy Infrastructure-

The PIMCO Dynamic Income Strategy Fund offers a lower yield than its peers and other PIMCO funds, making it less attractive for income-focused investors. Read more here.

Monday, January 6, 2025

PIMCO Cuts A Couple Of Distrib

Distribution cuts hit RCS and PCM CEFs hard due to high NAV premiums. Read why predicting such moves is tough and what this means for future funds.

Friday, December 27, 2024

The 2024 CEF Year-End Specials

Learn the latest special year-end distributions from closed-end funds like PIMCO Dynamic Income Strategy Fund and Barings Participation Investors. Click for more.

Thursday, December 19, 2024

PIMCO Closed-End Fund Declares

NEW YORK, Dec. 19, 2024 (GLOBE NEWSWIRE) -- The Board of Trustees of the PIMCO closed-end fund below (the “Fund”) has declared a special year-end distribution for the Fund’s common shares as summarize

Sunday, December 15, 2024

11 Closed-End Fund Buys In The

I reflect on adding to existing positions during BlackRock tender offers and consolidating holdings by selling out of a fund.

Monday, December 9, 2024

JRI: This Infrastructure And R

The Nuveen Real Asset Income and Growth Fund offers an attractive 11.86% yield, significantly higher than its peers, appealing to income-focused investors. Read more here.

Friday, November 15, 2024

FOF: Overweight Position To Eq

Cohen & Steers Closed-End Opportunity Fund has a unique investment strategy, solid yield, and inflation protection in varying economic conditions. See more here.

Monday, October 28, 2024

BANX And PDX: Generating Attra

ArrowMark Financial and PIMCO Dynamic Income Strategy Fund offer attractive distributions with potential for future payout increases. Learn more on BANX and PDX CEFs here.

Thursday, October 17, 2024

PIMCO CEF Update: Muni Coverag

Distribution coverage for PIMCO's Muni CEFs has surged, coinciding with the retirement of auction-rate preferreds, but the increase is too high. Click here for a PIMCO CEF update.

Thursday, October 10, 2024

The ABCs On CEFs

Closed-end funds offer unique advantages like fixed share numbers and access to diverse assets. Learn more on CEFs and their benefits for portfolio diversification.

Thursday, October 10, 2024

Saba Capital Management, L.P.'

Looking for stock market analysis and research with proves results? Zacks.com offers in-depth financial research with over 30years of proven results.

Tuesday, October 8, 2024

Saba Capital Management Reduce

Looking for stock market analysis and research with proves results? Zacks.com offers in-depth financial research with over 30years of proven results.

Tuesday, October 1, 2024

PIMCO Dynamic Income Strategy

Looking for stock market analysis and research with proves results? Zacks.com offers in-depth financial research with over 30years of proven results.

Tuesday, October 1, 2024

Saba Capital Management, L.P.

Looking for stock market analysis and research with proves results? Zacks.com offers in-depth financial research with over 30years of proven results.